Media Center

FPSO Brazil Congress 2026 Content

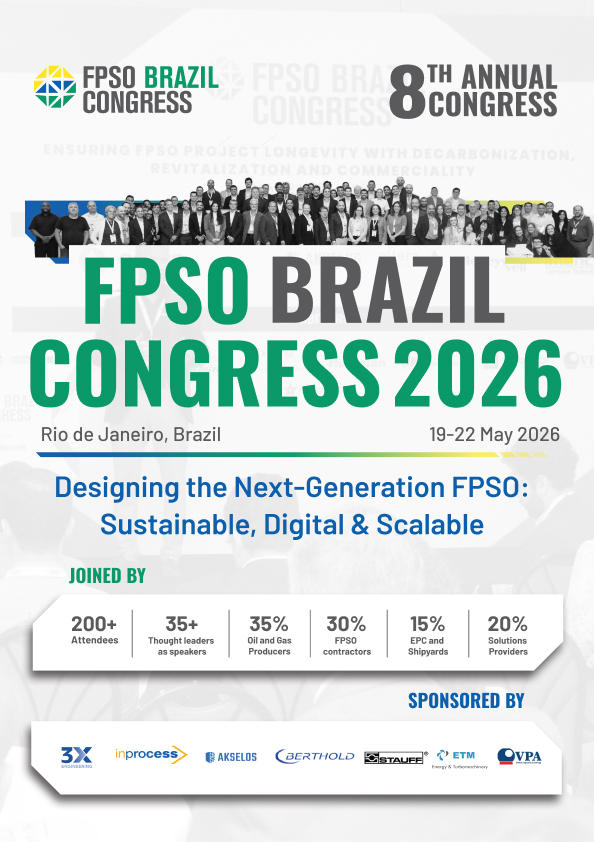

FPSO Brazil Congress 2026 Sponsorship & Exhibition Guide

Brazil is expected to achieve production of 7.7 billion barrels of crude oil in the pre-salt area in the period of 2023 – 2032, and daily production is expected to increase fourfold in the coming years. Both Oil and Gas Owners and FPSO Contractors are accelerating their expansion into pre-salt oil fields activities. This comes in addition to the 21 projects expected to take place in Brazil’s fields by 2026. At the same time, the industry continues its search for appropriate technology and tools to reduce carbon emission with the continued emphasis on greener operations to accomplish net-zero carbon emissions in the next 5 years. FPSO Brazil Congress is the focal point for industry leaders in the region to gather and explore best practices in optimizing project opportunities in this hotspot

Download our Sponsorship & Exhibition Guide to find out more about the opportunities that we have for you to be in front of South America's top FPSO and Oil & Gas leaders!

Your Complete FPSO Brazil 2026 Congress Briefing: Event Brochure + 2025 Post-Event Insights

Check out our Post Show Report to find out the sessions that took place in FPSO Brazil Congress 2025, the profile of our attendees, as well as information on our return in 2025!

Featured Content

South America FPSO Projects Outlook 2025 – 2029 : Awards, Operators and Newbuild Activity

South America continues to dominate the global FPSO landscape, awarding nearly half of all new floating production units over the past five years. With Petrobras and ExxonMobil responsible for more than 85% of regional FPSO demand, Brazil and Guyana have firmly established themselves as the center of gravity for the next phase of deepwater and ultra-deepwater expansion. This report provides a comprehensive view of FPSO awards from 2020–2024 and outlines expected activity from 2025–2029.

What’s Inside the Report:

> Full list of FPSOs awarded from 2020–2024

> Expected FPSO contracts by field operator, 2025-2029

> Forecast of FPSO awards expected globally and in South America

> Future hotspots: Falkland Islands, Suriname, Santos Basin Trends in newbuild vs redeployed FPSOs

FPSO Analytics: Market Overview of South America

South America continues to dominate the global floating production storage and offloading (FPSO) market, awarding nearly half of all global floater contracts in the last five years. Despite the rise in refurbished, relocated and reused FPSOs since early 2022, the region continues to favor the deployment of newbuild units, especially for large-scale projects in Brazil’s ultra-deepwater pre-salt polygon and offshore developments in Guyana. View the report to find out more

Equatorial Margin: A New Frontier of Exploration

The Equatorial Margin of Brazil is a burgeoning frontier for hydrocarbon exploration and development, attracting global attention for its untapped resources and strategic significance. This region spans a vast area along Brazil's northern coastline, encompassing basins such as Foz do Amazonas, Pará-Maranhão, Barreirinhas, and Potiguar. Its geological characteristics, resource potential, and environmental sensitivities make it a focal point for industry stakeholders and policymakers.

South America: An FPSO Hotspot

The South American region is the global leader in the floating production, storage and offloading (FPSO) segment, both in terms of active platforms and future projects. There will be an average of four FPSOs commencing operations in the region annually over the next five years, driven by developments in Brazil and Guyana, accounting for about 42% of the total global projects involving this type of platform. More than 80% of South American projects that will start operations between 2024 and 2028 are in Brazil, mainly operated by Petrobras.

Download the Report to find out more about FPSO Projects in South America. Join the Upcoming FPSO Brazil Congress 2024 happening on 21 - 24 May as we explore project fundamentals with South America's Oil & Gas leaders.

FPSO Market Challenges and Project Fundamentals in Brazil

Ahead of the FPSO Brazil Congress 2024, leading energy research and business intelligence company Rystad Energy has published the market report “FPSO Market Challenges and Project Fundamentals in Brazil” The offshore upstream segment will play a significant role in meeting oil and gas demand for the coming years, which keeps the relevance of offshore rig vessels, subsea, floating production storage and offloading (FPSO), and other offshore service segments. After several years of decline, the offshore oil and gas industry is entering a new era of investment as of 2022. Offshore capital expenditure (capex) increased 15% in 2023 and is forecasted to grow 12% next year, achieving a level of $93 billion.

FPSO Contractor's Guidebook

Ahead of the FPSO Brazil Congress 2024, we have put together an essential easy-to-digest guidebook to some of the biggest FPSO contractors. Understand more about their strengths and benefits, operational track records, execution models, and get in touch with their unique insights on the potentials of the industry

The Shift to Chinese Valves in FPSO Construction

The global market for floating production, storage and off-loading vessels (FPSOs) is undergoing significant structural change. As newbuilds and conversions proliferate, particularly in the Asia-Pacific region. The upstream supply chain is likewise evolving. One of the most notable trends is the growing adoption of valve packages manufactured in China instead of the traditional sourcing from European valve OEMs.

Download our whitepaper which details the shift towards Chinese Valves in FPSO Construction - produced by our sponsor Valves & Piping Asia Pte Ltd

Brazil & Beyond: The Evolution of FPSO Projects in South America

South America will remain a key region in the offshore oil and gas sector, especially for deep and ultra-deepwater projects, where regional spending could total around $170 billion across the offshore supply chain. A significant share of this investment will be allocated to projects in Brazil, especially those operated by Petrobras. Rystad Energy and FPSO Network has produced a report to showcase the potential for a significant surge in sanctioning of floating production storage and offloading (FPSO) projects over the next five years, following a slowdown in 2024.

Newsletter Publications

Edition 6 | Global & Africa FPSO Outlook 2026 and Beyond — and What Venezuela’s recent developments means for Offshore & FPSO industry

As we enter the new year, the global FPSO market is not slowing down — it is becoming more selective, disciplined, and strategically focused. Offshore investment remains resilient, but the factors driving FPSO demand are evolving rapidly. In Edition 6, we covered

1. Global and regional FPSO headlines (South America & Africa)

2. FPSO market outlook and forecasts for 2026 and beyond

3. Venezuela’s oil & gas sector: current state and future implications

4. Africa’s role in the next phase of FPSO deployment

5. Key industry reports and events shaping market direction

Edition -7 | DOF secures FPSO mooring contract for Guyana, Petrobras outperforms 2025 production targets and more

In Newsletter Edition 7 we covers latest World, Africa and Brazil headlines including:

> Deepwater investment signals from Nigeria, as fiscal incentives clear the path for Shell’s Bonga South West development

> West Africa’s offshore revival, with Benin’s long-dormant Sèmè Field set to resume production after nearly three decades

> Where FPSO and subsea capital is being committed, with recent contract awards pointing to near-term execution priorities

> Petrobras outperforms 2025 production targets: role of FPSOs and way forward

> Fresh market intelligence and reports, tracking FPSO awards, recent FIDs, and Africa’s next FPSO sanctioning cycle (2026–2033)

Additional Content Download

Providing Energy to a Low Carbon Future - Equinor

Learn from Equinor via their presentation on: Project Execution Strategies to Deliver the Bacalhau FPSO in a Challenging Global Context

This case study dives deep into an overview of Equinor’s Bacalhau FPSO and planned date of operations as well as the journey behind the Bacalhau FPSO and its potential benefits for the country. The presentation also explores new ways to incorporate sustainability, low carbon, and new technologies in FPSOs.

This presentation is delivered by Camila Bleser, Lead Planner Bacalhau Project, Equinor Brasil Energia Ltd.

FPSO Brazil Congress 2024 Post Show Report

Check out our Post Show Report to find out the sessions that took place in FPSO Brazil Congress 2024, the profile of our attendees, as well as information on our return in 2025! The 2024 edition took place in Windsor Barra, Rio de Janeiro, Brazil as we brought in over 150+ leaders from South American's Top FPSO and Oil & Gas industry.

Attendee Profile List - FPSO Brazil Congress 2025

Find out who's attending the FPSO Brazil Congress!

Attending companies include Petrobras, TotalEnergies, Equinor, SBM Offshore, Shell, Yinson and many more.

Past Content

What Makes FPSO Redeployment Difficult

The Seven Point Funding Checklist

How can we balance CAPEX and OPEX?

For many in the FPSO industry the issue of balancing CAPEX and OPEX remains a thorn in their side.

FPSO projects are resource-intensive with high CAPEX on top of high operating and maintenance costs (high OPEX). This puts pressure on the industry to continuously evolve the business models and tap into innovations to achieve commercial success. What can projects do to balance the CAPEX and OPEX?

We spoke with Eduardo Chamusca de Azevedo, Country Director – SBM Brazil and Felipe Baldissera Gabriel, Commercial and Contracts Manager, MODEC to get their thoughts.

Maintaining Vessel Integrity & Operational Excellence

IQPC and the FPSO Network conducted an in-depth industry survey with our global community to provide a holistic and well-balanced benchmark when it comes to vessel integrity and FPSO operations. We hope you find this report useful.

In this report, we will look at:

- Mid-Late Stage FPSO Life-Cycle & Operations

- Industry benchmark - Asset Integrity Challenges

- Industry benchmark - FPSO Vessel Maintenance Works

- Industry benchmark - Maintenance Costs & Budget

- Technology - Future of Vessel Integrity Management & FPSO Operations

Rystad Energy Industry Report - FPSO Brazil Market Insights & Opportunities

Together with leading energy research and business intelligence company Rystad Energy, the FPSO EMEA Market Insights & Opportunities Industry Report details the impact on Brazil's FPSO projects due to global events.

Grab your copy of the report to see:

- The forecast global energy spending due to the impact of the European Union's efforts to become less dependent on external supplies

- Energy Security strategies used by European countries as they rapidly advance into the low-carbon and renewables sector

- Factors driving the record-high number of FPSO Awards over the next few years that could potentially lead to supply constraints

- FPSO projects updates including current projects under Petronas, MISC, Yinson, and Ping Petroleum

- Key opportunities present in the EMEA market for contractors, operators, and solution providers looking to penetrate the market

These are exclusive insights researched and produced by Rystad Energy and are a most-download report for all Oil & Gas professionals.

Download your copy below to read the latest report!

Unlocking Brazil's Offshore Wind Potential

With FPSO Brazil Congress 2023 returning this year, we are excited to bring you our latest article on Unlocking Brazil's Offshore Wind Potential.

This report was produced in collaboration with Gustavo Ferreira, Project Developer at Corio Generation, and the teams from Corio Generation and Servtec.

Grab your free copy of this article to find out more about:

- Brazil's offshore wind industry - with increased investment from oil & gas operators

- Future opportunities for offshore wind in Brazil - including job opportunities

- The biggest factors preventing the widespread adoption of offshore wind in Brazil

Expert Insights on FPSO Contract Modelling

Like its European counterparts, Brazil’s FPSO market has seen increased activity of late. Needless to say, contract models remain a major factor for the industry — whether a company wants to build, own, operate or transfer a vessel will affect the type of contract it uses. Here we explore ways in which the industry is approaching fast- tracking FPSO projects.

With expert insight from Felipe Baldissera Gabriel from MODEC, Filipe Costa from Yinson and Jorge Luiz Mitidieri, OCYAN, we deep dive into the key changes; the main pros and cons of certain contracting models as well as external factors.

Download the article to explore ways in which the industry is approaching fast- tracking FPSO projects.

Realizing Greener and Low-Manned FPSOs in Brazil

Ahead of the FPSO Brazil Congress, we spoke to industry leaders to find out what is driving the growth of projects in the region, trends affecting the market and challenges of low-manned vessels.

Insights and feedback were provided by:

- Bruno Azevedo Liberato, Maintenance and Planned Shutdown, Petrobras

- Francisco Eugenio Magarinos Torres, Development and Production Coordinator, Pre-Sal Petroleo SA

- Rafael Torres, Business Development Director, SBM Offshore

- Jorge Luiz Uchoa Mitidieri, VP Executive, Ocyan

Grab your copy of this exclusive market insights report!

2023 Brazil Market Outlook - Rystad Energy Report

Optimizing developments while boosting exploration: How Brazil can make the most of its resources amidst the energy transition

In this special Rystad Energy outlook on the upstream sector in Brazil, we will first focus on the outlook for upstream resource replacement, and how the country needs to fast-track exploration of its undiscovered resources to boost resilience and examine its current pipeline of oil and gas projects up for sanctioning.

How international players can navigate the Brazilian FPSO market

Brazil is one of the world’s foremost Oil and Gas leaders. The previously “closed” economy is now open to the world thanks to new local content policy and regulations set in place.

Here we explore the latest local content updates and what it means for the international market in regard to project execution models and working with local teams.

We also talk with Pietro Ferreira, Senior Regional Analyst at the Energy Industries Council’s (EIC) regional office in Rio de Janeiro about his take on the local content requirements and regulatory changes occurring in Brazil.

Download the article to read more.

How to Fast-Track Projects in the Brazilian Market

Brazil is seen to be a key driver of the FPSO market over the next few years. Therefore to maximize this window of opportunity, project execution and development need to be fast-tracked as much as possible.

With input from industry leaders in the Brazil market, we explore different ways in which the industry can do so.

Download the article to learn more.